Qualify to Save an Average of 30% by Paying With HSA/FSA

We’ve partnered with TrueMed to help you save an average of 30% on your Peak Pure & Natural® purchases by way of income tax savings!

What is TrueMed?

TrueMed is a payment tool that allows health and wellness companies to accept HSA/FSA funds. They partner with leading brands, like Peak Pure & Natural®, to enable the payment and reimbursement of HSA/FSA funds for qualified health and wellness purchases.

How does it save me money?

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses to treat, mitigate, or prevent a diagnosed medical condition.

Because HSA/FSAs use pre-tax money, you're getting more purchasing power for your dollars. Rather than pay taxes on income and spend it on health items, qualified customers can use pre-tax funds to invest in root cause interventions.

Shop at Peak Pure & Natural® with your HSA/FSA

At Peak Pure & Natural® we believe our nutritional supplements can be of benefit medically, and our new partners at Truemed agree. Through our collaboration with Truemed, eligible customers can now use Health Savings Account (HSA) or Flexible Spending Account (FSA) funds on Peak Pure & Natural® products!

This means you may be eligible to buy your favorite supplement products with pre-tax dollars, resulting in net savings of 30% on average.

HSAs and FSAs were created for you to spend tax-advantaged dollars on products and services that can treat or prevent medical conditions and Truemed is making it easy to do just that.

Visit Truemed to discover even more ways to spend your tax-free HSA/FSA funds.

How to check out with HSA/FSA funds

The steps to using your HSA and FSA funds towards your Peak Pure & Natural® products is easy. Here’s a step-by-step guide to walk you through the order process.

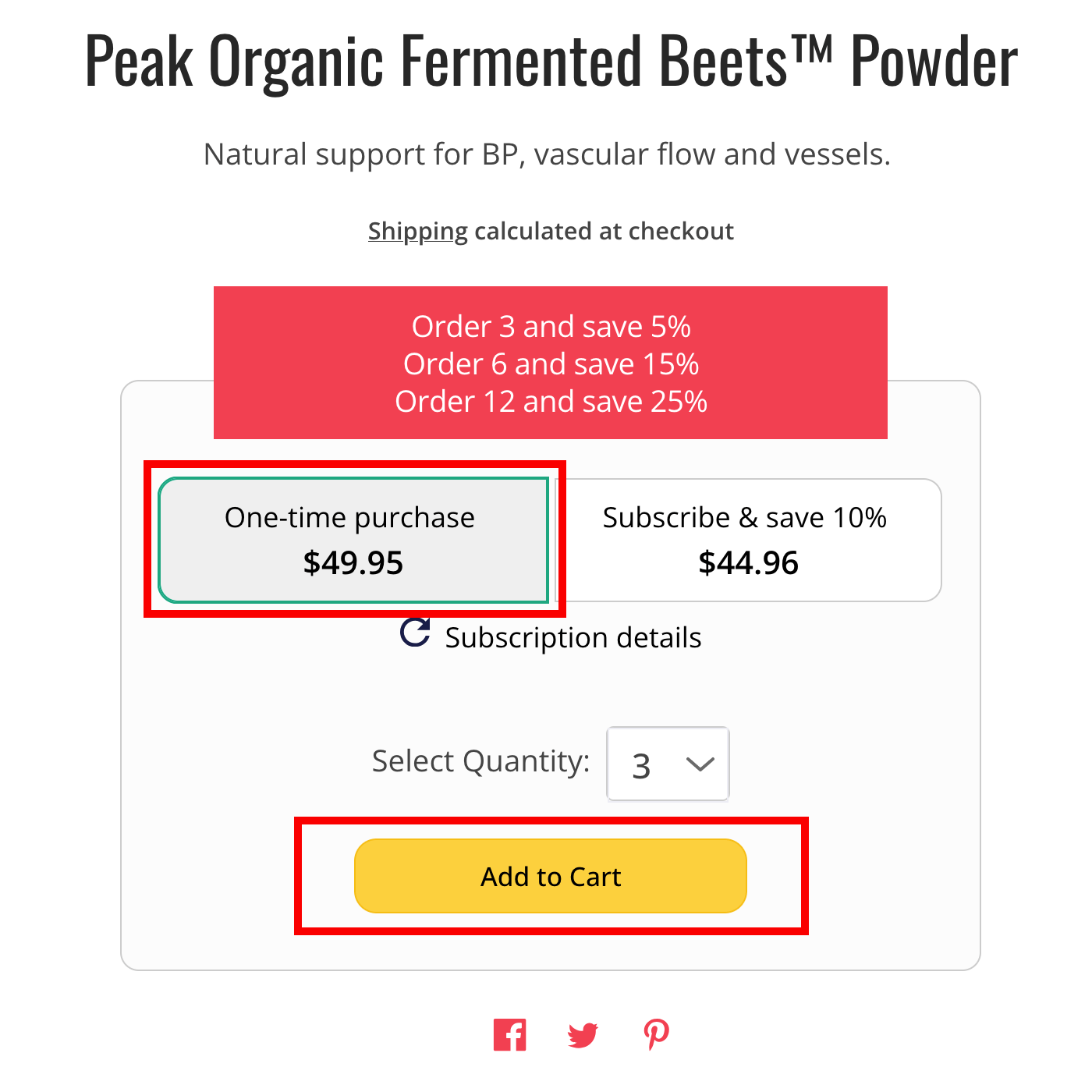

STEP 1:

Add products to your cart

Please ensure all items are “one-time,” as we cannot accept HSA/FSA cards for subscription purchases at this time.

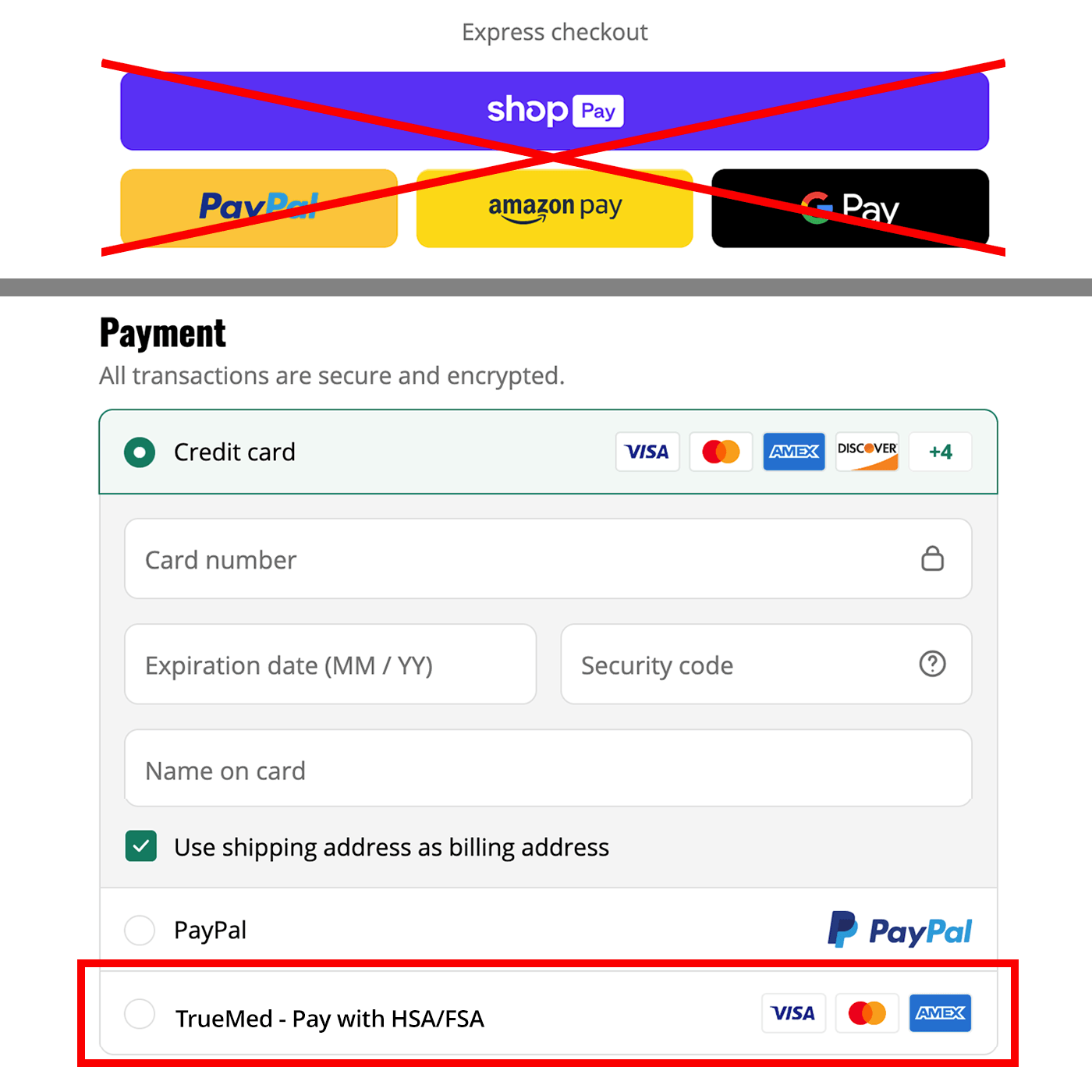

STEP 2:

Select Truemed as your payment option at checkout

At checkout, you’ll see an option to pay with “TrueMed – Pay with HSA/FSA”. Choose this option to proceed then click on “Pay now”.

Don’t use any express checkout options (Ex. Shop Pay, PayPal, Amazon Pay, Google Pay, Venmo).

If you are signed into “Shop Pay”, check out as a guest.

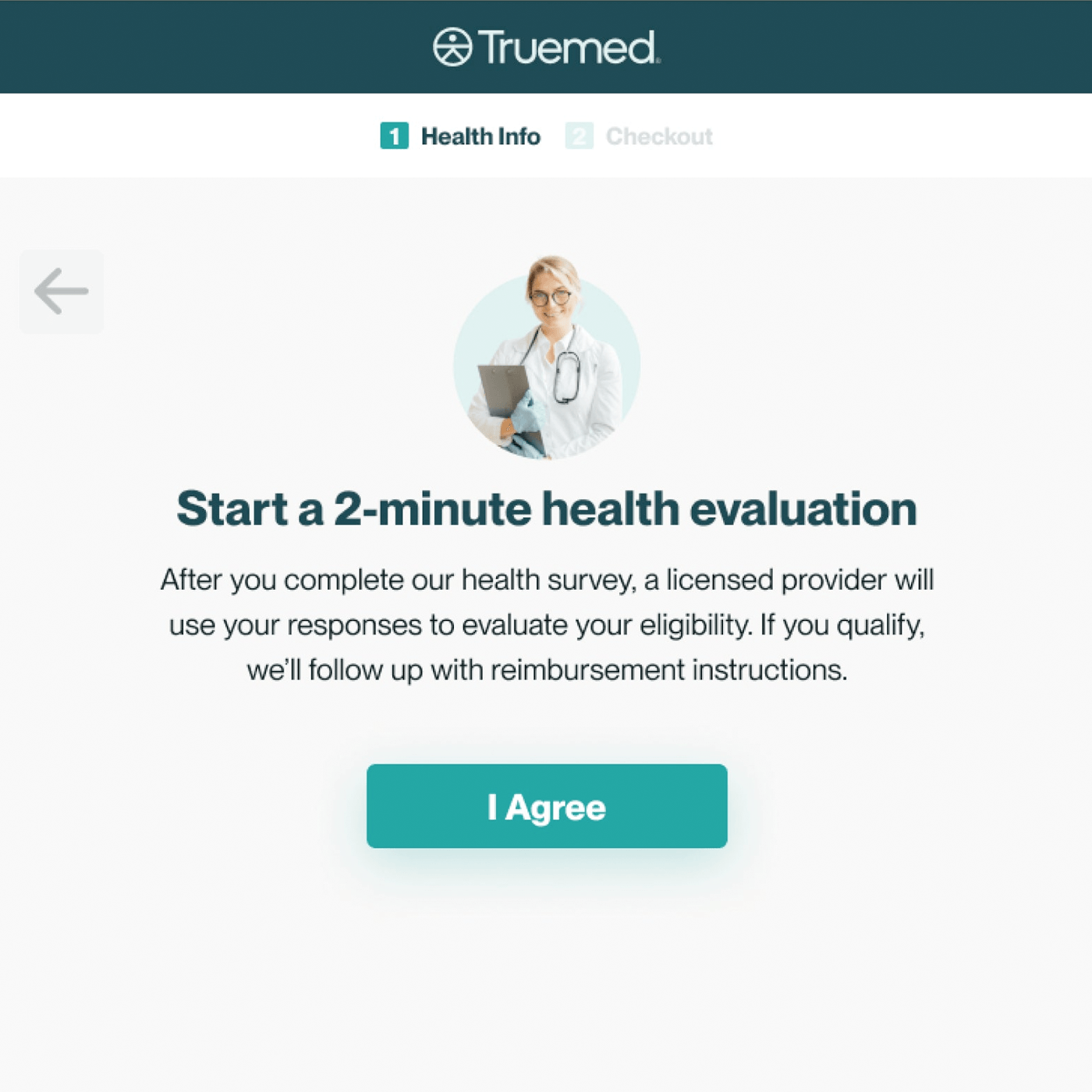

STEP 3:

Take a brief health survey

TrueMed will guide you through a short health survey. Answer questions about your HSA/FSA and your health to confirm eligibility for reimbursement.

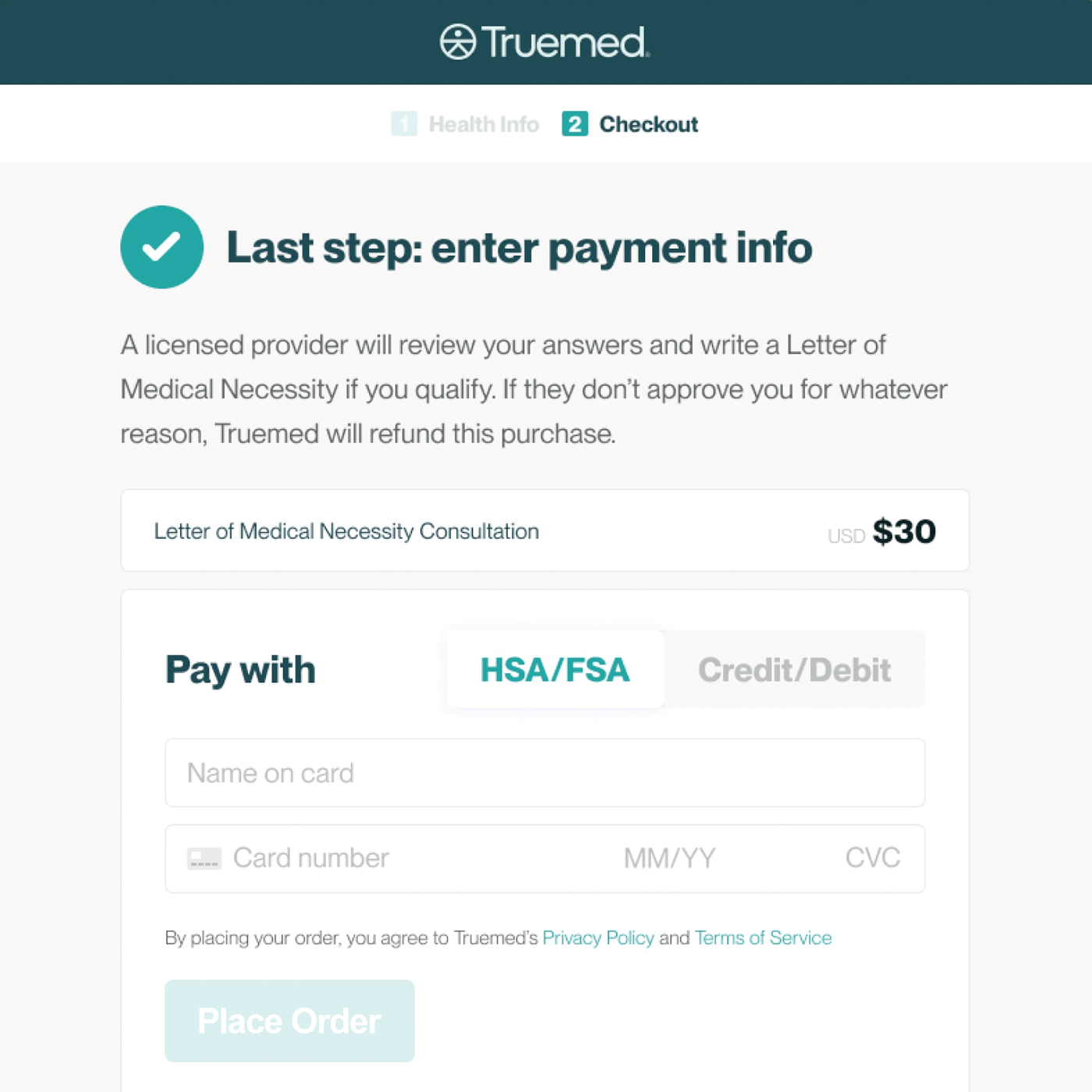

STEP 4:

Complete checkout through Truemed

You will be redirected to TrueMed’s website where you will be prompted to provide payment info. You may pay with one of the following options:

- Credit or debit card: (Recommended!) If you input a credit or debit card, you will be emailed instructions on how to get reimbursed.

- HSA/FSA card: If you pay with your HSA/FSA card, there’s no other work you need to do. Truemed will send paperwork to ensure compliance.

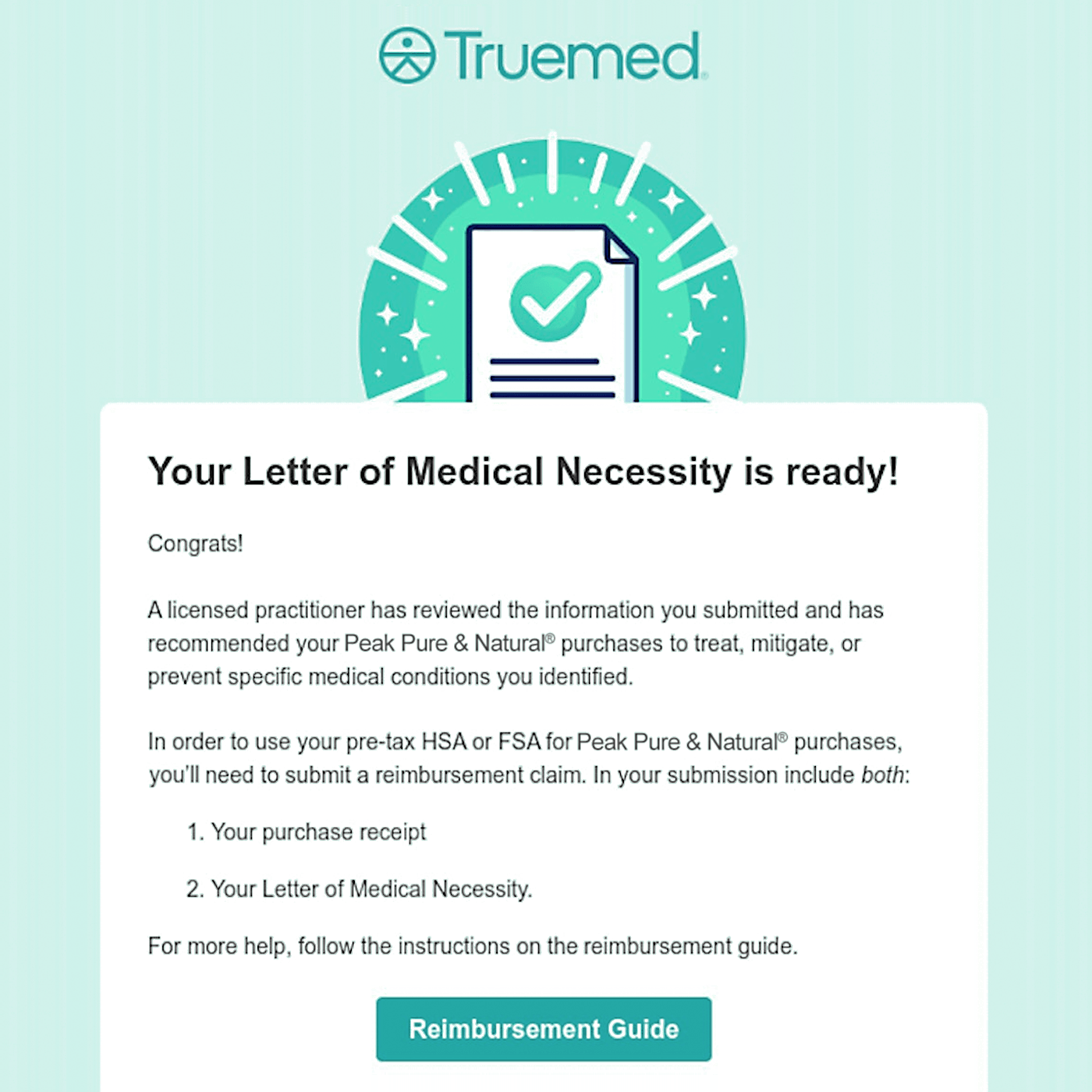

STEP 5:

Receive your Letter of Medical Necessity

A licensed medical provider will review your responses. Truemed will email you a Letter of Medical Necessity within 48 hours if you qualify.

Once you’re approved, that’s it! You’ll receive an order confirmation and effectively save up to 30-40% on your order by way of income tax savings!

Eligible Products

Common Questions

HSA/FSA accounts were created so individuals could use pre-tax money to pay for expenses used to treat, mitigate, or prevent a diagnosed medical condition. Because HSA/FSAs use pre-tax money, you’re getting more purchasing power for your dollars. Rather than pay taxes on income and then spend it on health items, qualified customers can use pre-tax funds to invest in their health.

An individual can contribute up to $4,150 pretax to their HSA per year, or $8,300 for a family (plus an additional $1,000 if you are at least 55 years old. Individuals can contribute up to $3,200 pretax to their FSA per year (with an additional $500 in employer contributions allowed).

Health savings accounts (HSA) and flexible spending accounts (FSA) are programs that allow you to set aside pre-tax dollars for eligible healthcare expenses. If you’re unsure whether or not you have an HSA or FSA account, please check with your employer or insurance company.

Yes, simply select Truemed as your payment option at checkout and use your FSA or HSA card as you would any other credit card.

Yes. If you prefer to use your regular credit card, Truemed will send you instructions on how to submit for reimbursement from your HSA//FSA administrator.

The items in your Truemed Letter of Medical Necessity (“LMN”) are now qualified medical expenses in the same way a visit to the doctor’s office or pharmaceutical product is.

There are thousands of studies showing food and exercise is often the best medicine to prevent and reverse disease. Exercise qualifies as a qualified medical expense with an LMN. Food, supplements, and other wellness purchases qualify as medical expenses if they treat or prevent an illness, and a doctor substantiates the need. Your Truemed LMN satisfies all IRS requirements to make your wellness spend fully reimbursable.

There is no cost to you, as long as you are shopping with a Truemed partner merchant.

You can use your HSA/FSA dollars all year long. However, FSA dollars expire at the end of the year and unused money may not rollover into the next year. Make sure to spend the rest of your FSA dollars before December 31st — use it, so you don’t lose it!

Generally it takes 24-48 hours. In some cases, Truemed’s provider team will require additional time to issue a letter of medical necessity based on the needs associated with an individual qualification survey. If you aren’t seeing your letter in your inbox, check spam, then reach out to us at support@truemed.com for help.

Unfortunately, Truemed’s services are for individuals who have HSA or FSA accounts (or plan to fund one during open enrollment).

Unfortunately, Truemed is currently only available in the United States.